Last Updated on 03/01/2018 by GS Staff

The first thing that probably comes to your mind when thinking about assets is likely cash or maybe a piece of property. These are assets that you can see and touch in the form of money, a building, and so on. However, intangible assets are different in that they lack a physically existence. Furthermore, they must also not be a financial instrument such as a stock or bond.

Examples of Intangible Assets

Below are examples of intangible assets that are commonly found today’s businesses:

Goodwill

Goodwill is the excess amount above fair value that a company pays to acquire another business. For example, assume ABC Corp has a fair value of $1,000,000. Now assume that another company called XYZ Corp acquires ABC Corp for $1,200,000. XYZ Corp pays $200,000 above fair value which is considered goodwill. ABC Corp will record $200,000 in goodwill in its books.

Trademark

According to the United States Patent and Trademark Office (USPTO), a trademark is a word, phrase, symbol, and/or design that identifies and distinguishes the source of the goods of one party from those of others. Examples of trademarks include the golden arches of McDonald’s, the Nike swoosh symbol, the brand name Apple, and the cartoon characters of Scooby-Doo.

Franchise

A franchise involves a franchisor and franchisee. The franchisor allows the franchisee the right to sell goods or services under its trade name. The franchisee operates the franchise business under the terms of the franchise agreement. McDonald’s is often used as a popular example of a franchise. McDonald’s, the corporation, franchises most of its restaurants to other individuals/companies who operate the McDonald’s according to the terms of the franchise arrangement.

Copyright

A copyright protects artistic work, print, pictures, photos, film, records, and music from being used without authorization. It gives the copyright holder the exclusive legal right to whatever is secured by the copyright. The current copyright law states that copyright protection is limited to 70 years beyond the death of the creator. Moat songs heard on the radio, as example, are copyrighted.

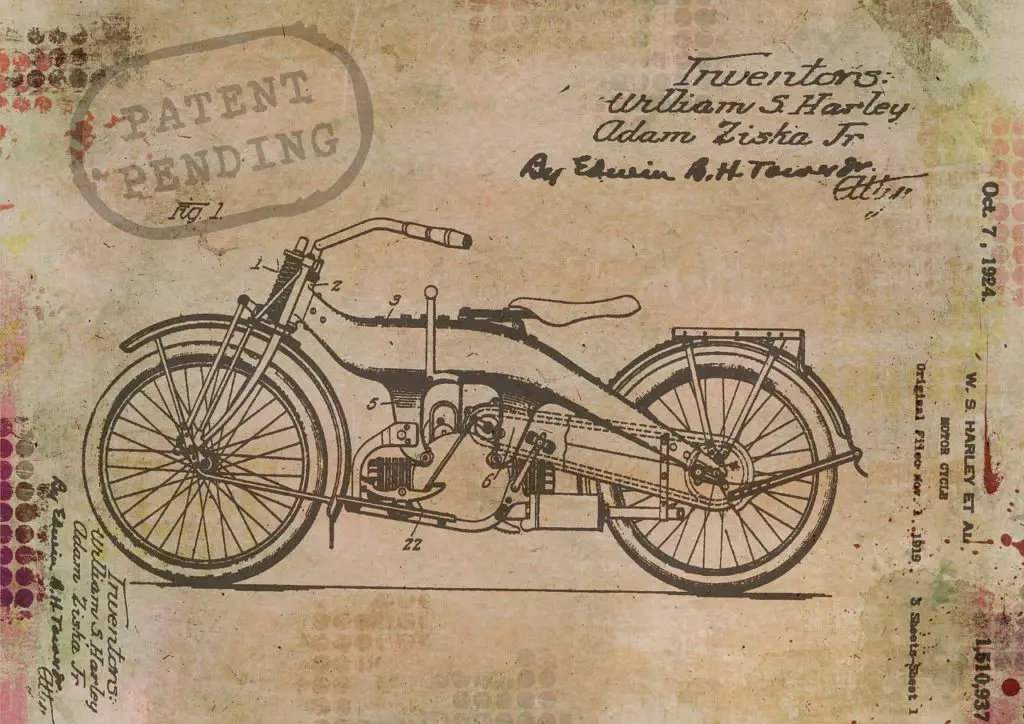

Patent

A patent is granted to protect a new product or process that has been invented. Generally, it gives the patent holder the legal right, for 20 years, to sell and manufacture whatever is covered by the patent. The USPTO states that patents can be obtained by a person who “invents or discovers any new and useful process, machine, manufacture, or composition of matter, or any new and useful improvement thereof, may obtain a patent”.

Accounting for Intangible Assets

Intangible assets have either a limited life or an indefinite life. Copyrights and patents are limited life assets because their legal protection ends at some point in the future. These type of intangible assets are amortized. This means that their book value is reduced gradually over their useful life. Intangible assets that have an indefinite life are not amortized.

Intangible assets are tested for impairment at least yearly. An impairment test judges whether the assets carrying value exceeds its fair market value. If this is the case, an impairment loss is recognized by the company. Impairment tests vary based on the type of intangible asset that is being tested.