Examples of Intangible Assets

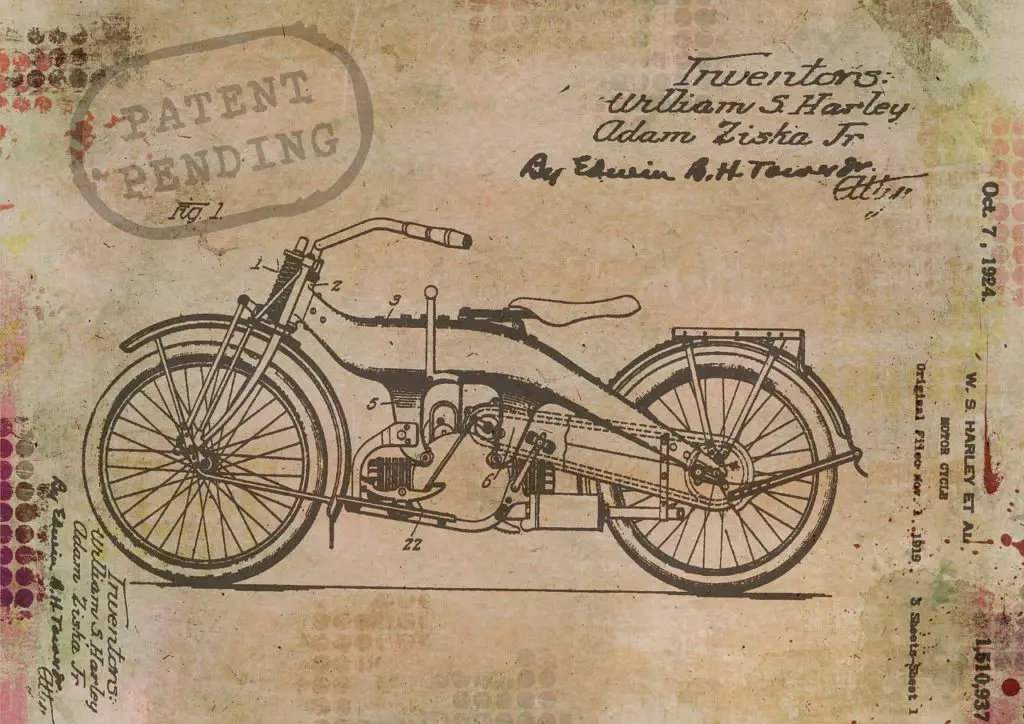

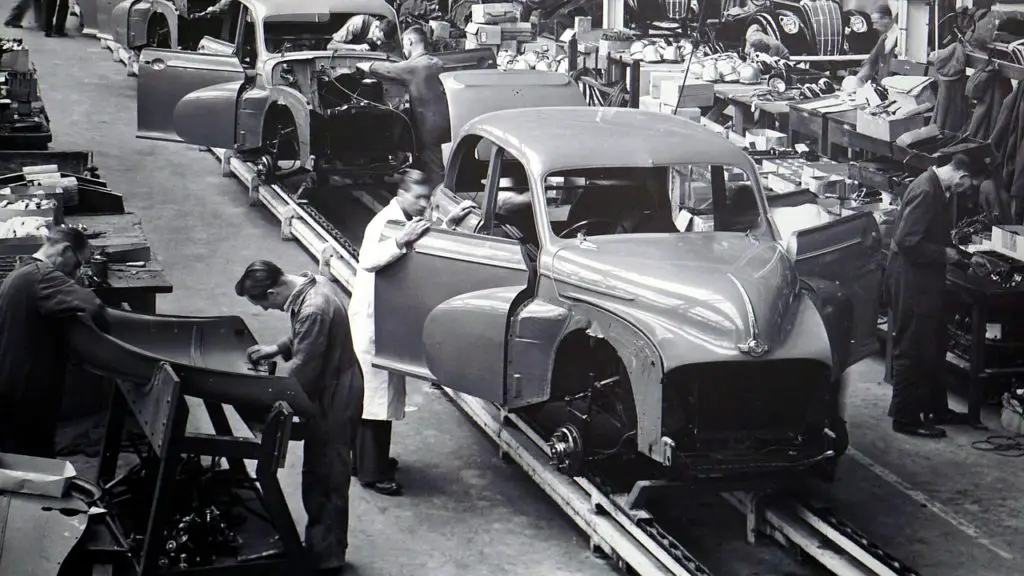

The first thing that probably comes to your mind when thinking about assets is likely cash or maybe a piece of property. These are assets that you can see and touch in the form of money, a building, and so on. However, intangible assets are different in that they lack a physically existence. Furthermore, they […]

Examples of Intangible Assets Read More »