Last Updated on 06/02/2017 by GS Staff

[otw_shortcode_dropcap label=”Q:” size=”large” border_color_class=”otw-no-border-color”][/otw_shortcode_dropcap] Do credit cards have routing numbers?

[otw_shortcode_dropcap label=”A:” size=”large” border_color_class=”otw-no-border-color”][/otw_shortcode_dropcap] Credit cards do not have routing numbers. Credit cards use the credit number to connect the account to the credit card issuer and the credit card holder.

Credit Card Number Dissected

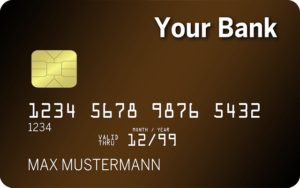

Let’s take a look at what the numbers on the credit card mean. The above example card will be used for reference.

- The first digit of the credit card number identifies the type of card. If the credit card number starts with a 3, the card is an American Express, Diner’s Club, or Carte Blanche. Visa is associated with the number 4, Mastercard has a first digit of 5, and Discover is linked to 6.

- The first six digits is known as the issuer identification number. These numbers pinpoint who issued the card such as a bank. In the card example these numbers would be 123456.

- The remaining digits (789876543), not counting the last digit, is the account number of the credit card holder.

- The last number (2) is the check digit. This digit is determined mathematically based on the previous numbers on the card. Without getting technical, this number is used to minimizes human errors when the credit card number is typed out.

What Is A Routing Number

A routing number (routing transit number) is associated with a checking or savings account. The routing number identifies the financial institution where you opened your bank account. It is used for receiving and sending transactions.

For example, your employer may need your bank’s routing number to transfer your paycheck into your bank account. You would need to ensure that you give your employer the correct routing number so that your pay ends up at the location where you hold a bank account.

If you still hold write out checks, the routing number is the first digits on the lower left of your check. Additionally, you can often find the routing number online if you do not have checks. View your bank’s website and search for the routing number associated with your bank location. If you have online banking, the bank may list the routing number when you access your account information.

Banks often have several routing numbers that they use based on region. When in doubt, speak with a bank representative where you opened your account to determine the routing number you should use. It is obviously important that you use the correct number so that transactions get to where they need to be.