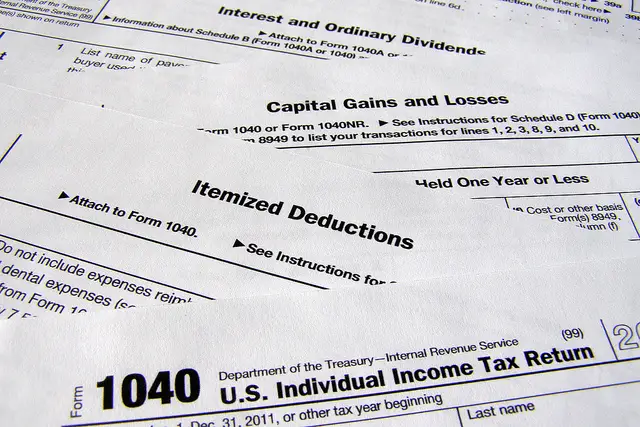

What Do Underwriters Look for on Tax Returns?

[otw_shortcode_dropcap label=”Q:” size=”large” border_color_class=”otw-no-border-color”][/otw_shortcode_dropcap] What do underwriters look for on tax returns? [otw_shortcode_dropcap label=”A:” size=”large” border_color_class=”otw-no-border-color”][/otw_shortcode_dropcap] An underwriter may review tax returns for a number of reasons. Some of these reasons may be to verify rental income, self-employment income, or investment/retirement income. The underwriter’s job is to verify that the borrower makes enough income to […]

What Do Underwriters Look for on Tax Returns? Read More »