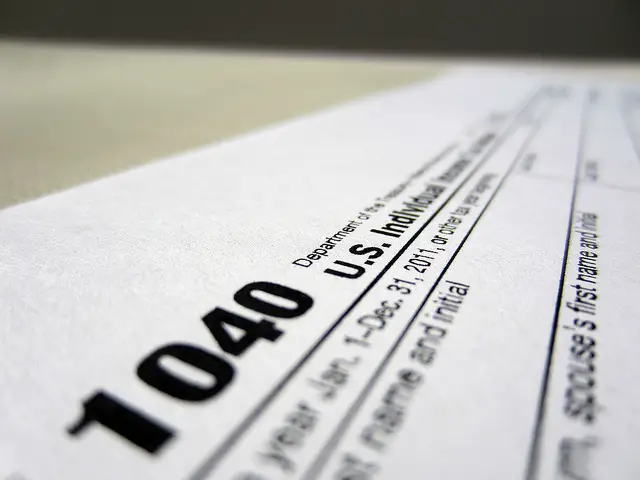

Can I Get a Mortgage on Benefits?

[otw_shortcode_dropcap label=”A:” size=”large” border_color_class=”otw-no-border-color”][/otw_shortcode_dropcap] Generally, you can get a mortgage on some types of benefits even if you do not have a source of employment. There are various types of benefits you might receive such as social security, pension, veteran affairs (VA) and unemployment. Lenders commonly want to see at least a three year continuance …